Advertisement

-

Published Date

January 30, 2021This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

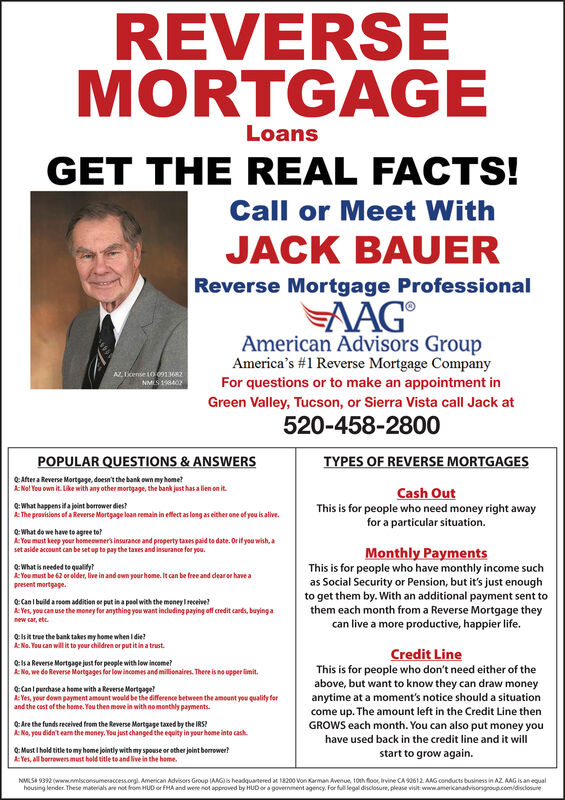

REVERSE MORTGAGE Loans GET THE REAL FACTS! Call or Meet With JACK BAUER Reverse Mortgage Professional AAG American Advisors Group America's #1 Reverse Mortgage Company AZ Iicense 10 09138z NMLS 198402 For questions or to make an appointment in Green Valley, Tucson, or Sierra Vista call Jack at 520-458-2800 POPULAR QUESTIONS & ANSWERS TYPES OF REVERSE MORTGAGES Q:After a Reverse Mortgage, doesn't the bank own my home? A:No! You own it. Like with any other mortgage, the bank just has a lien on it. Cash Out Q: What happens ifa joint borrower dies? A The provisions of a Reverse Mortgage loan remain in effect as long as either one of you is alive. This is for people who need money right away for a particular situation. Q: What do we have to agree to? A You must keep your hemeeuners insurance and property taves paid to date. Or if you wish, a set aside acount can be set up to pay the taves and insurance for you. Monthly Payments This is for people who have monthly income such as Social Security or Pension, but it's just enough to get them by. With an additional payment sent to them each month from a Reverse Mortgage they can live a more productive, happier life. e What is needed to quality? A You must be 62 or elder, live in and ewn your home. It can be free and dear or have a present martgage. 0:Can I build a reom addition or put in a pool with the meney I receive? AYes, you can use the money for anything you want including paying off credit cards, buying a new car, etc. Qkit true the bank takes my home when Idie! A:Na. You can will it to your children or put it in a trust. Credit Line This is for people who don't need either of the above, but want to know they can draw money anytime at a moment's notice should a situation come up. The amount left in the Credit Line then GROWS each month. You can also put money you e:ka Reverse Mortgage just for people with low income? A: No, we de Reverse Mortgages for low incomes and millionaires. There is no upper limit. Q: Can I purchase a home with a Reverse Mortgagel A Yes, your down payment amount would be the difference between the amount you qualify for and the cest of the heme. You then move in with no monthly payments. 0: Are the funds received from the Reverse Mortgage taxed by the IRS? ANa, you didn't ean the meney. Tou just changed the equity in your home into cash. have used back in the credit line and it will Q: Must I hold title to my home jointly with my spouse or ether joint borrower? A Yes, all borrowers must hold title to and live in the home. start to grow again. NMLSI 9392 (www.nmisconsumeraccess.orgl. American Advisors Group ANG)s headquatered at 18200 Von Karman Avenue, 10th floo, Irvine CA 92612. AAG conducts business in AZ AAG is an equal housing lender. These materials ane not from HUD or FHA and were not approved by HUDor a government agency, For full legal disclosure, please visit www.americanadvisongroup.com/disclosure REVERSE MORTGAGE Loans GET THE REAL FACTS! Call or Meet With JACK BAUER Reverse Mortgage Professional AAG American Advisors Group America's #1 Reverse Mortgage Company AZ Iicense 10 09138z NMLS 198402 For questions or to make an appointment in Green Valley, Tucson, or Sierra Vista call Jack at 520-458-2800 POPULAR QUESTIONS & ANSWERS TYPES OF REVERSE MORTGAGES Q:After a Reverse Mortgage, doesn't the bank own my home? A:No! You own it. Like with any other mortgage, the bank just has a lien on it. Cash Out Q: What happens ifa joint borrower dies? A The provisions of a Reverse Mortgage loan remain in effect as long as either one of you is alive. This is for people who need money right away for a particular situation. Q: What do we have to agree to? A You must keep your hemeeuners insurance and property taves paid to date. Or if you wish, a set aside acount can be set up to pay the taves and insurance for you. Monthly Payments This is for people who have monthly income such as Social Security or Pension, but it's just enough to get them by. With an additional payment sent to them each month from a Reverse Mortgage they can live a more productive, happier life. e What is needed to quality? A You must be 62 or elder, live in and ewn your home. It can be free and dear or have a present martgage. 0:Can I build a reom addition or put in a pool with the meney I receive? AYes, you can use the money for anything you want including paying off credit cards, buying a new car, etc. Qkit true the bank takes my home when Idie! A:Na. You can will it to your children or put it in a trust. Credit Line This is for people who don't need either of the above, but want to know they can draw money anytime at a moment's notice should a situation come up. The amount left in the Credit Line then GROWS each month. You can also put money you e:ka Reverse Mortgage just for people with low income? A: No, we de Reverse Mortgages for low incomes and millionaires. There is no upper limit. Q: Can I purchase a home with a Reverse Mortgagel A Yes, your down payment amount would be the difference between the amount you qualify for and the cest of the heme. You then move in with no monthly payments. 0: Are the funds received from the Reverse Mortgage taxed by the IRS? ANa, you didn't ean the meney. Tou just changed the equity in your home into cash. have used back in the credit line and it will Q: Must I hold title to my home jointly with my spouse or ether joint borrower? A Yes, all borrowers must hold title to and live in the home. start to grow again. NMLSI 9392 (www.nmisconsumeraccess.orgl. American Advisors Group ANG)s headquatered at 18200 Von Karman Avenue, 10th floo, Irvine CA 92612. AAG conducts business in AZ AAG is an equal housing lender. These materials ane not from HUD or FHA and were not approved by HUDor a government agency, For full legal disclosure, please visit www.americanadvisongroup.com/disclosure